-

How do you stack up to the average credit card debt?

What is credit card debt? Americans have several different types of debt, beyond credit card debt, which includes mortgages, auto loans, and student loans. All are totaling up to

-

Americans Have Credit Card Debt. A Lot of It.

American’s Average Credit Card Debt: How Do You Measure Up? Despite minor growth in household income levels over the past few years, Americans are still largely burdened by consumer

-

How Does Debt Fit into Your Retirement Planning?

I wish I spent more time retirement planning: An all too common wish. Regardless where you live or what work you engage in, you always have a plan to

-

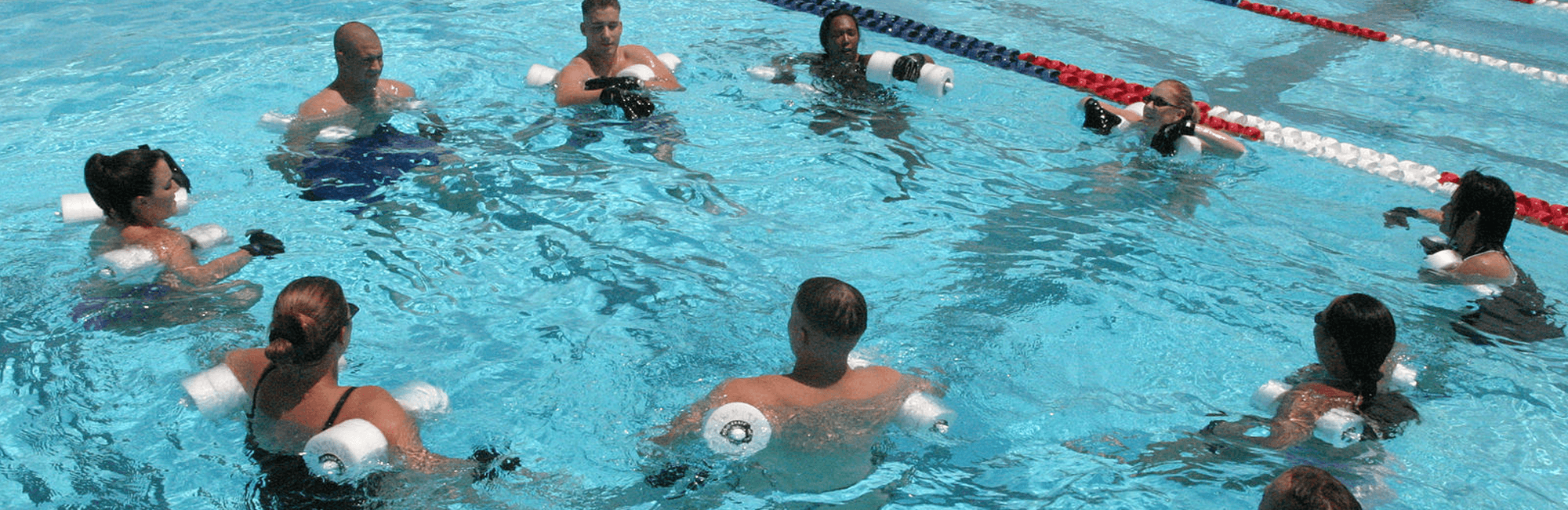

Making minimum payments on your credit card is like treading water.

The Real Cost of Making Minimum Payments on Your Credit Cards Like any rational consumer, minimizing loss and maximizing gains is the ultimate goal for your finances. A credit

-

Worried about taxes on your settled debt? You may not need to.

In this article from Creditcards.com – a little known tax exemption is discussed. This exemption is for people that have had debt cancelled, or settled. The IRS considers this

-

Handling Finances Through Life Changes.

Change is good, except when it’s not. Life is full of uncertainty and change is inevitable. But in most cases, the human brain tends to crave certainty and consistency.